Pay off debt and achieve your financial goals.

Expert guidance on how to eliminate debt and make your money work for you.

We were carrying $213,931 in debt, it would have taken us 30 years to pay off. Now, we’ll pay it off in 9 years.

Shelly J.

How does Debt Free Life® work?

For individuals who are paying their bills on time and contribute to a savings or retirement account, Debt Free Life is a innovative way to pay off your debt using the cash value of a specialized whole life insurance policy.

Get Your Personalized Debt Elimination Report

Using our exclusive software, your certified Debt Free Life consultant will generate a personalized debt elimination report showing you how and when to pay off each debt and:

Build Cash Value

Extra funds are redirected into the cash value of your policy. Now, your money will accrue guaranteed interest and annual dividends.

Pay Off Debts

Using the money in the cash value of your policy, you will begin to pay off the principal balance of your debts. By borrowing money from yourself, you can pay off your debts faster and reduce interest owed to banks and lenders.

Start Living Debt Free

Once your debts are paid off, you can use your policy funds for large purchases, retirement, or a child’s education.

How does Debt Free Life® work?

For individuals who are paying their bills on time and contribute to a savings or retirement account, Debt Free Life is a innovative way to pay off your debt using the cash value of a specialized whole life insurance policy.

Get Your Personalized Debt Elimination Report

Using our exclusive software, your certified Debt Free Life consultant will generate a personalized debt elimination report showing you how and when to pay off each debt and:

Build Cash Value

Extra funds are redirected into the cash value of your policy. Now, your money will accrue guaranteed interest and annual dividends.

Pay Off Debts

Using the money in the cash value of your policy, you will begin to pay off the principal balance of your debts. By borrowing money from yourself, you can pay off your debts faster and reduce interest owed to banks and lenders.

Start Living Debt Free

Once your debts are paid off, you can use your policy funds for large purchases, retirement, or a child’s education.

I appreciate being more educated on how to better handle our finances.

L. Dillworth

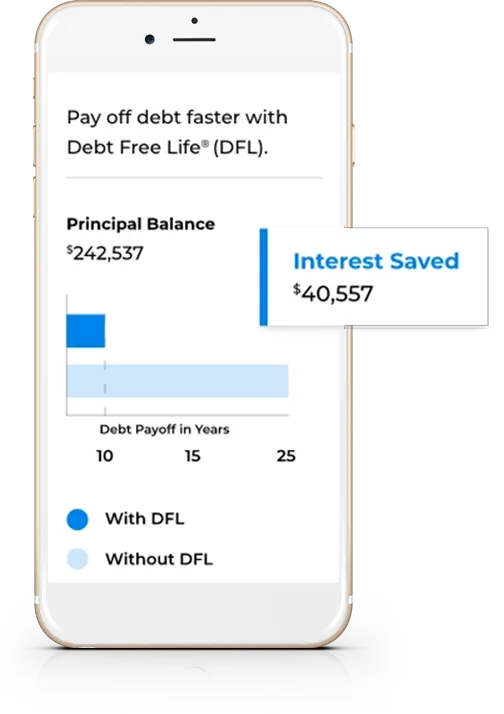

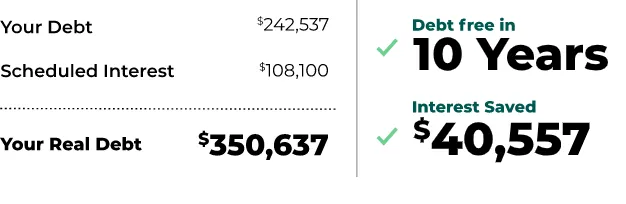

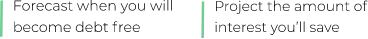

Personalized Debt Elimination Report

Your certified Debt Free Life consultant will present a personalized report to visually represent your debts and scheduled interest. Your consultant will show you how redirecting inefficient dollars into the cash value of a whole life insurance policy will help you eliminate debt incrementally and build savings. You will also find out when you’ll become debt free and see how much interest you will save.

Join thousands on the path to financial freedom.

I know the month and year we’ll be out of debt.

Jennifer B.

Ready To Get Started?

Schedule a Consultation

Submit some basic information then meet with a certified Debt Free Life consultant over the phone or in person.

Review Your Personalized Debt Elimination Report

Learn more about your debt and scheduled interest in your personalized debt elimination report.

Take Back Control

Your consultant will show you how to redirect your inefficient funds into a specialized whole life insurance policy to pay off your debts and reduce interest.

Continued Support From Your Debt Free Life Consultant

Your certified Debt Free Life consultant will provide continued support throughout the process to help you get out of debt and achieve your financial goals.

In 6.5 years, I’ll be debt free and saving over $108,000 in interest.

Patrick D.

See how Debt Free Life helps our clients.

Start Achieving Your Financial Goals

Debt Free Life helps you eliminate debt with the cash value savings component of a permanent life insurance policy. Read more about permanent life insurance and how these specialized policies can help you achieve your financial goals.

FAQs

We’ve got you covered.

When should I begin my Debt Free Life journey?

As soon as you are ready to start paying off debt! Your age, health, and Covid-19 exposure can affect your ability to qualify. The sooner the better – begin by filling out our short form and a certified Debt Free Life consultant will be in touch to schedule your free consultation.

How much does Debt Free Life cost?

By redirecting overpayments or discretionary income into the cash value of your policy, you become your own bank and pay off debts with no additional out-of-pocket expenses. Premiums for whole life insurance, like other types of life insurance, depend on your age and health at the time you apply.

What can I expect during my free consultation?

In your first consultation with your Debt Free Life consultant, you will discuss your existing debts, interest rates, principal balances and all current payments you’re making towards debts. Your consultant will then use our exclusive Debt Free Life software to break down the structure and amortization schedule for each debt. They will prepare a complete debt analysis and personalized Debt Elimination Report to review with you.

Is Debt Free Life a debt consolidation plan?

No, Debt Free Life is for people who are paying off their debts on time and trying to find a more efficient way to pay them off faster. We redirect your inefficient dollars to fund a specialized whole life policy with our exclusive software to create the most efficient strategy.

What are the advantages of Debt Free Life?

The main advantage of Debt Free Life is putting you back in control of your finances by eliminating debt. You will also reduce the amount of interest paid to lenders while accruing funds in the cash value component of a whole life insurance policy.

Will Debt Free Life impact my credit score?

As you pay off debts with the guidance of a certified Debt Free Life consultant, your credit score may improve. There are no credit checks required when applying for a life insurance policy.

FAQs

We’ve got you covered.

When should I begin my Debt Free Life journey?

As soon as you are ready to start paying off debt! Your age, health, and Covid-19 exposure can affect your ability to qualify. The sooner the better – begin by filling out our short form and a certified Debt Free Life consultant will be in touch to schedule your free consultation.

How much does Debt Free Life cost?

By redirecting overpayments or discretionary income into the cash value of your policy, you become your own bank and pay off debts with no additional out-of-pocket expenses. Premiums for whole life insurance, like other types of life insurance, depend on your age and health at the time you apply.

What can I expect during my free consultation?

In your first consultation with your Debt Free Life consultant, you will discuss your existing debts, interest rates, principal balances and all current payments you’re making towards debts. Your consultant will then use our exclusive Debt Free Life software to break down the structure and amortization schedule for each debt. They will prepare a complete debt analysis and personalized Debt Elimination Report to review with you.

Is Debt Free Life a debt consolidation plan?

No, Debt Free Life is for people who are paying off their debts on time and trying to find a more efficient way to pay them off faster. We redirect your inefficient dollars to fund a specialized whole life policy with our exclusive software to create the most efficient strategy.

What are the advantages of Debt Free Life?

The main advantage of Debt Free Life is putting you back in control of your finances by eliminating debt. You will also reduce the amount of interest paid to lenders while accruing funds in the cash value component of a whole life insurance policy.

Will Debt Free Life impact my credit score?

As you pay off debts with the guidance of a certified Debt Free Life consultant, your credit score may improve. There are no credit checks required when applying for a life insurance policy.

Let’s Get Started

Are you ready to become debt free?

© Copyright 2022 Generation 1. All Rights Reserved.